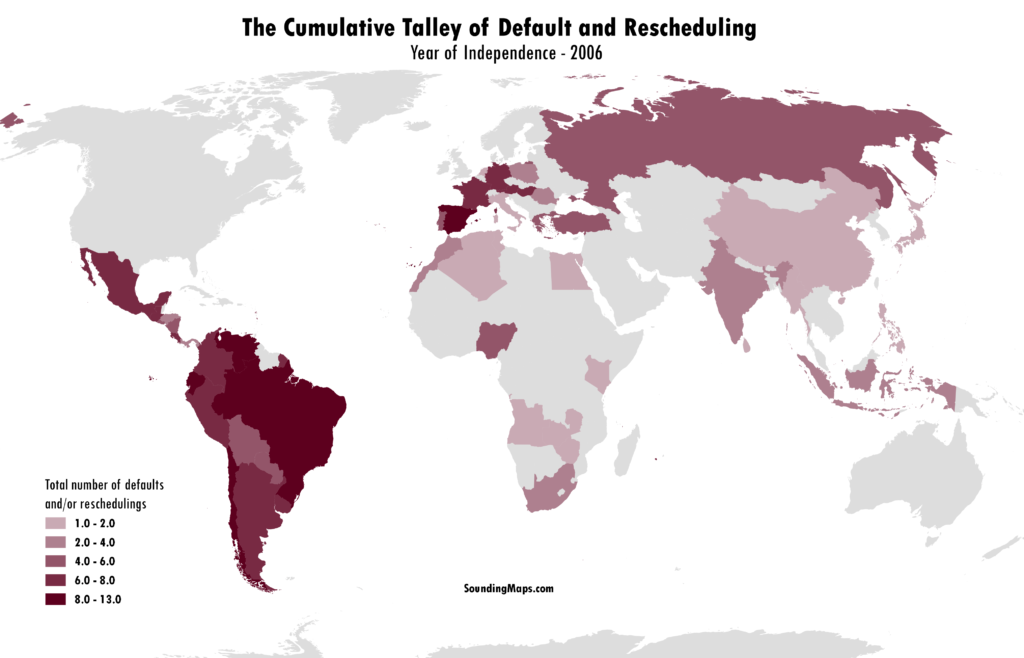

An explosion of international defaults took place starting in the nineteenth century. This resulted from a combination of the development of international capital markets together with the emergence of a number of new nation states. Countries debt defaults are illustrated with dark red. A majority of these countries with debt defaults are in South America.

Debt rescheduling are included, which the international finance theory literature rightly categorizes as negotiated partial defaults.

Most of Africa and Asia was colonized during this time period, allowing Latin America a substantial head start.

Top Countries by Default:

- Spain – 13

- Venezuela – 10

- Brazil – 9

- Chile – 9

- Ecuador – 9